a blog by linakariim

-

the eternal passage

in the whispering breeze of a vanishing day,where shadows of cedar and myrtle sway,death arrives, not as a thief of light,but a kindred spirit in the softness of night. “behold,” it whispers in tones that…

No comments on the eternal passage -

echoes of longing, a journey to the Divine

All is known in the sacredness of silence. Silence gives answers. In the silent chambers of our soul, there dwells a longing, a yearning so profound, an ache that echoes through the corridors of beings.…

-

whispers of the heart

There are countless of metaphysical concept in every Rumi’s poem, that includes one of his very amazing works, the Mathnawi-yi ma’nawi which will be freely translated as The Couplets of Inner Meaning. in whispers soft,…

-

In the sacred garden of our souls, where the blossoms of connection flourish, there lies a profound truth that whispers through the fragrant breeze of existence: when you behold a beauty in me, it is…

-

a book polygamist

OK, here’s a confession. Actually I was in a period of reviewing slump. Of the many hobbies I have, I see reading as my longest hobby, followed by running, and writing. I’ve actually done quite…

-

Introducing my YouTube Channel, “Kisah Penuh Hikmah”

Assalamualaikum dear readers! I have just launched my very own YouTube channel called “Khazanah Hati: Kisah Penuh Hikmah.” As a passionate blogger and a dedicated spiritual murid, I wanted to create a platform where I…

-

Serat Kalbu, A book club

I’m delighted to introduce you to “Serat Kalbu,” the book club I founded yesterday. The name is derived from two Javanese words: “Serat” (writing or text) and “Kalbu” (heart or soul). It reflects our shared…

-

consider starting a book club and other random stories

These past days I was thinking how if I have my own book club even though I am the only member. I know that I am used to review and talk about books already, but…

-

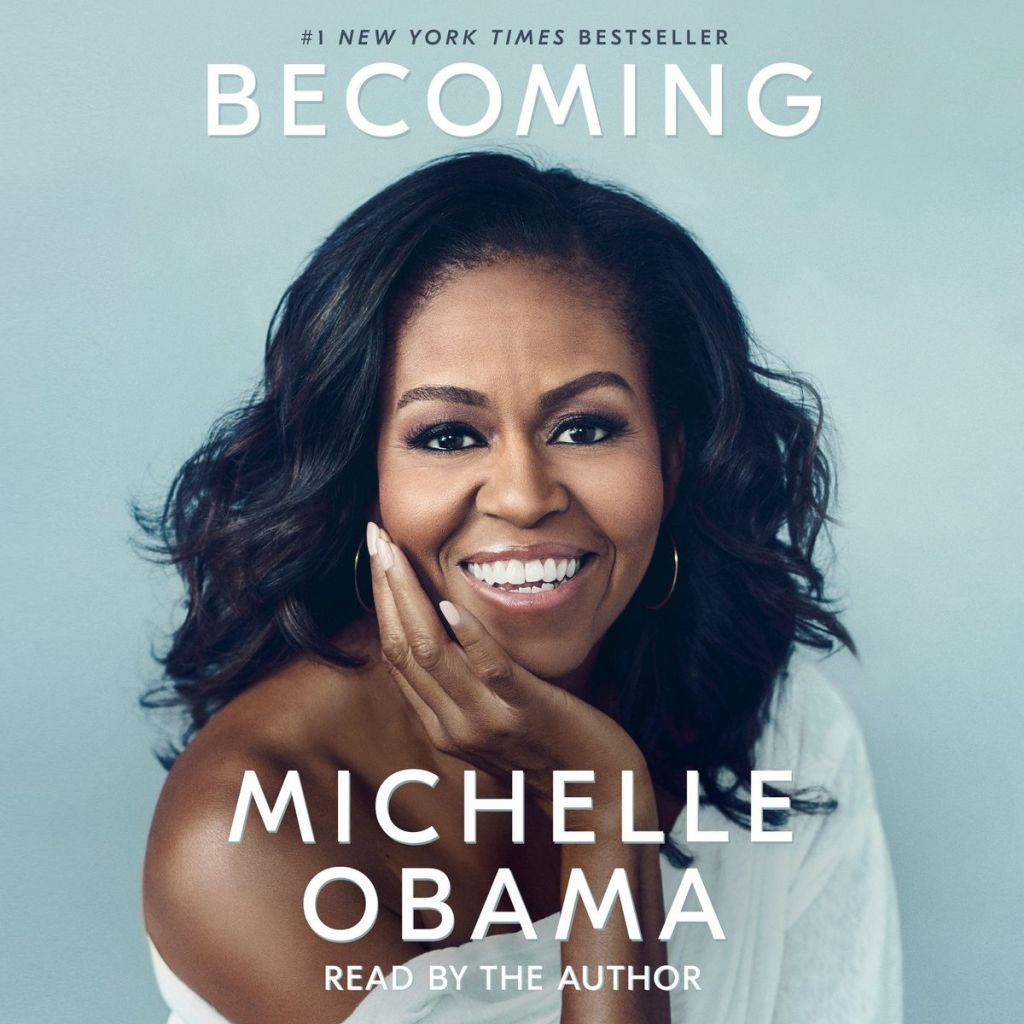

#36 Becoming

Judul : BecomingPenulis : Michelle ObamaPenerbit : Viking PressTahun cetakan Pertama: 13 November 2018Halaman : 426halamanRating: 4/5 Becoming Me “Becoming” merupakan memoar yang ditulis oleh mantan Ibu Negara Amerika Serikat, Michelle Obama. Dalam buku tersebut, Michelle Obama berbagi perjalanan pribadinya…

Got any book recommendations?